When Do Drug Patents Expire? Understanding the 20-Year Term and Real-World Timelines

Most people assume that when a drug patent is granted, the company has 20 years to sell it without competition. That’s not true. In reality, the clock starts ticking long before the drug even hits the pharmacy shelf. By the time a new medication gets FDA approval, drug patent expiration is often just a few years away-sometimes only seven or eight. That’s why the real story isn’t the 20-year term on paper. It’s what happens before, during, and after that window closes.

How the 20-Year Clock Actually Works

The U.S. patent system gives drug makers a 20-year term from the date they first file the patent application. That’s set by federal law (35 U.S.C. § 154). But here’s the catch: drug development takes years. Clinical trials alone can last 6 to 10 years. That means if a company files a patent in 2010, and the drug gets approved in 2020, they’ve already used up half their exclusive time before they even start selling. The result? Most brand-name drugs have just 7 to 12 years of actual market exclusivity. That’s not a flaw-it’s how the system was designed. The patent term isn’t meant to reward time spent in the lab. It’s meant to protect the commercial life of the product after it’s approved.Why Patents Don’t Last 20 Years in Practice

Think of it like a race. The patent is the starting gun. But the drug has to run a marathon before it can even begin competing. Before approval, companies must prove safety and effectiveness through three phases of human trials. That process costs billions and takes over half the patent term. By the time the FDA says yes, the patent is already aging. Take Humira (adalimumab), one of the best-selling drugs ever. Its main patent was filed in 1996. It got FDA approval in 2002. That left just 8 years of exclusivity before generics could enter. But because of patent extensions and layered protections, it stayed protected until 2023-21 years after filing. That’s the exception, not the rule.Patent Term Extensions: The Legal Lifeline

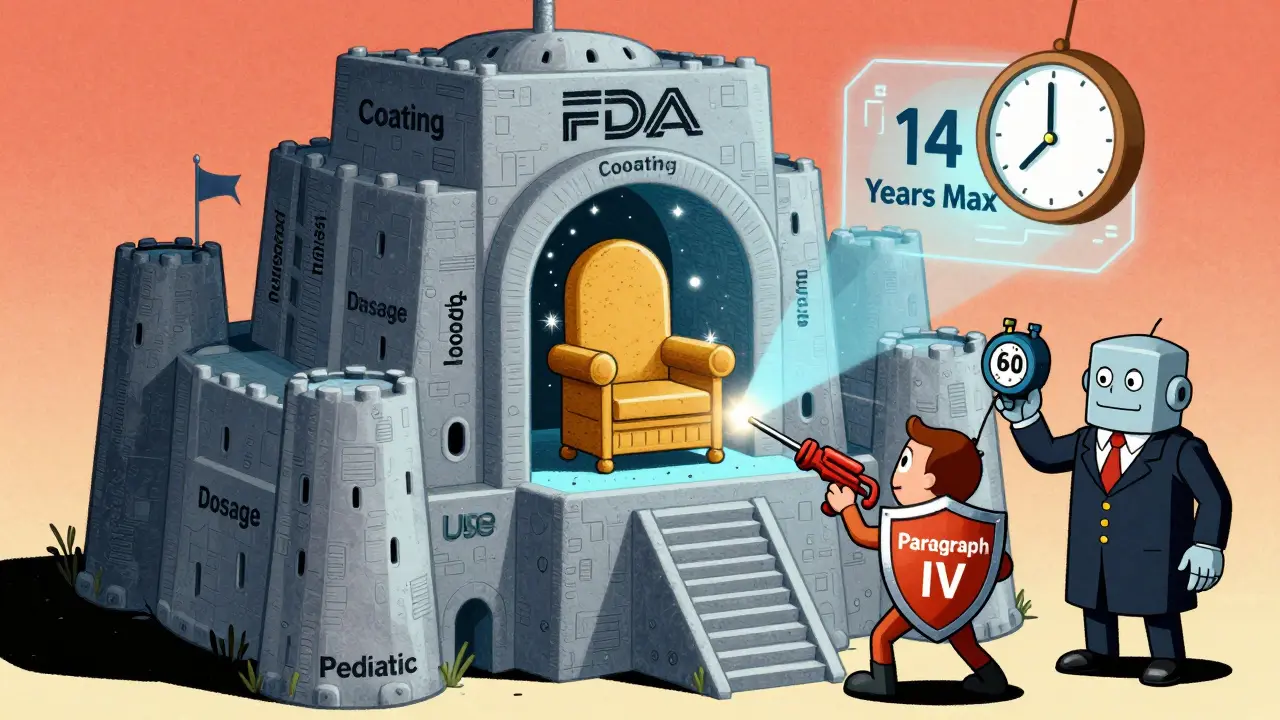

The Hatch-Waxman Act of 1984 created a way for drug companies to get back some of that lost time. If the FDA took too long to approve a drug, the patent can be extended-up to 5 extra years. But there’s a catch: the total time from FDA approval to the end of exclusivity can’t go beyond 14 years. For example, if a drug gets approved in 2020 and has a 20-year patent filed in 2010, the patent would normally expire in 2030. But because 10 years were used up in clinical trials, the company can apply for a 4-year extension. That pushes the expiration to 2034. But since 14 years after approval is 2034, that’s the cap. The extension only makes sense if the FDA delay was significant. There’s also a strict deadline: companies must apply for this extension within 60 days of FDA approval. Miss it, and you lose it. Many small biotech firms don’t have the legal teams to catch this, and they end up losing valuable time.Other Types of Protection Beyond Patents

Patents aren’t the only shield. The FDA gives out separate periods of exclusivity that don’t depend on patents at all. These can stack on top of patent protection.- New Chemical Entity (NCE) exclusivity: 5 years. During this time, the FDA can’t even review a generic version, even if the patent has expired.

- Orphan Drug Exclusivity: 7 years for drugs treating rare diseases (fewer than 200,000 patients in the U.S.).

- New Clinical Investigation Exclusivity: 3 years if the company adds a new use, dosage, or formulation that requires new clinical trials.

- Pediatric Exclusivity: 6 months added to any existing exclusivity period if the company studies the drug in children.

The Patent Cliff and What Happens Next

The moment a drug’s last protection expires, it’s called the “patent cliff.” This is when generic or biosimilar versions flood the market. Prices drop fast. For small molecule drugs-like pills or injections-generic versions typically capture 80% to 95% of sales within 18 to 24 months. Take Eliquis (apixaban). Its patent expired in December 2022. By mid-2023, generics had grabbed 35% of the market. By the end of the year, prices fell 62%. Patients paid less. Insurers paid less. The brand lost billions. But it’s not always that simple. For biologics-complex drugs made from living cells, like Humira or Enbrel-generics are harder to copy. These are called biosimilars. They take longer to develop and get approved. So instead of 90% market share in two years, biosimilars might only reach 40% to 60% over five years.How Companies Stretch Protection

Big pharma doesn’t wait for the patent to expire to plan. They start building their next defense during Phase II trials-7 to 8 years before approval. They file multiple patents: one for the active ingredient, another for the pill coating, another for how it’s made, another for how it’s used to treat a new condition. This is called “patent thickets.” Spinraza, a drug for spinal muscular atrophy, has over 20 patents covering different aspects. Its last patent expires in 2030, even though the main compound patent was filed in 2013. That’s 17 years of protection. The FTC has flagged some of these tactics as “evergreening”-filing weak patents on minor changes just to delay generics. For example, changing the delivery method from injection to pill form might not be a real innovation, but it can trigger a new patent and a new 20-year clock.What Happens When Patents Are Challenged

Generic companies don’t wait for patents to expire. They challenge them before they do. Under the Hatch-Waxman Act, a generic maker can file an “ANDA” with a “Paragraph IV certification,” saying the patent is invalid or won’t be infringed. If the brand company sues within 45 days, the FDA is forced to delay approval for 30 months. That’s a huge delay. But if the generic wins the lawsuit, they get 180 days of exclusive rights as the first to market. That’s a massive incentive. Between 2019 and 2023, 62% of pharmaceutical patents were challenged through the Patent Trial and Appeal Board (PTAB). Many patents get canceled or narrowed. That’s why some drugs lose protection years before their patent expiration date.

Global Differences

The U.S. isn’t the only country with drug patents. But rules vary. In Japan, the patent term is calculated differently. The clock doesn’t start ticking until five years after filing or three years after requesting examination-whichever comes later. That gives companies more time to protect their drugs. The European Union and Canada have similar extension systems, but their rules are stricter. In the EU, extensions are capped at 5 years, but total exclusivity can’t exceed 15 years from approval. The World Health Organization has pushed for reducing patent terms to 15 years to improve access to medicines. But drug companies argue that with an average R&D cost of $2.3 billion per drug, they need the full 20 years to recoup investment.What This Means for Patients and Providers

Patients often don’t realize why a drug suddenly becomes more expensive-even after its patent expires. Sometimes, insurance switches you to a generic, but the copay is higher because the generic isn’t covered under the same tier. Other times, a pediatric exclusivity extension kicks in, and you’re stuck paying brand prices for six more months. Pharmacists see it firsthand. One pharmacist on Reddit noted that for small molecule drugs, generics hit 90% market share within 18 months. But for biologics, patients wait years before they get affordable options. The real cost isn’t just money. It’s access. When a drug’s patent expires, millions get cheaper treatment. But when companies delay that date through legal tricks, patients pay more, and healthcare systems strain under the burden.What’s Changing in 2025 and Beyond

In 2024, Congress introduced the “Restoring the America Invents Act,” which could eliminate some patent term adjustments. If passed, it could shorten exclusivity by 6 to 9 months on average. The USPTO is also automating patent term calculations to reduce errors and delays. That means fewer accidental extensions and more accurate expiration dates. Meanwhile, the industry is shifting toward combination therapies. AstraZeneca’s Tagrisso, for example, combines two drugs into one pill. Even though the original compound patent expires in 2026, the combination patent extends protection to 2033. The bottom line? The 20-year patent term is just the starting point. The real expiration date is a maze of legal extensions, regulatory exclusivities, litigation, and strategic filings. For patients, it means lower prices. For drugmakers, it means constant innovation-or constant legal defense.Understanding when a drug’s protection ends isn’t just for lawyers and investors. It’s for anyone who relies on prescription medicine. The next time you hear about a “patent cliff,” remember: it’s not just a financial event. It’s a moment when access to life-saving drugs changes forever.

How long does a drug patent last in the U.S.?

A drug patent in the U.S. lasts 20 years from the date the patent application was first filed. But because clinical trials and FDA review take 6 to 10 years, most drugs only have 7 to 12 years of actual market exclusivity before generics can enter. Patent extensions and regulatory exclusivities can add more time.

Can a drug patent be extended after it expires?

No, a patent cannot be extended after it expires. But companies can apply for a Patent Term Extension (PTE) before expiration to make up for delays caused by FDA review. The extension can add up to 5 years, but total exclusivity from FDA approval cannot exceed 14 years. The application must be filed within 60 days of approval.

What’s the difference between patent expiration and exclusivity expiration?

A patent protects the invention legally. Exclusivity is a regulatory protection from the FDA that blocks generics from being approved, even if the patent has expired. For example, a drug might lose patent protection in 2025 but still be protected by 5 years of New Chemical Entity exclusivity until 2030. Both must expire before generics can legally enter the market.

Why do some drugs stay expensive even after patent expiration?

Some drugs stay expensive because of delays in generic approval, insurance formulary restrictions, or because they’re biologics-which are harder to copy. Even after patent expiration, biosimilars can take years to reach the market. Also, some insurers don’t cover generics at lower tiers, so patients pay more out-of-pocket.

How do generic drug makers know when a patent expires?

They check the FDA’s Orange Book, which lists all patents associated with brand-name drugs and their expiration dates. Generic manufacturers use this to time their applications. If a patent is listed, they must either wait until it expires or file a Paragraph IV certification challenging its validity.

What happens if a patent expires but no generic is available?

If no generic is available, the brand drug may remain the only option, and prices may stay high. This can happen if the drug is complex to manufacture, if there are no generic companies interested, or if patent litigation is dragging on. In rare cases, the FDA may allow importation of generics from other countries under emergency programs.

Duncan Careless

December 29, 2025 AT 09:24Wow, didn’t realize the patent clock starts ticking before the drug even exists. That’s wild. Feels like they’re already halfway to the finish line before the race begins.

Samar Khan

December 29, 2025 AT 10:22Pharma companies are laughing all the way to the bank 🤑 while people can’t afford their meds. 20 years? More like 20 years of greed. 😒

Russell Thomas

December 29, 2025 AT 16:15Oh so the ‘20-year patent’ is just a fairy tale they tell you at the pharmacy counter? Cool story. Next they’ll tell me the ‘free market’ actually exists. 🙄

Patent thickets? More like patent spam. File 20 patents on changing the pill color and call it innovation. Genius. Or just… evil. I can’t tell anymore.

Joe Kwon

December 30, 2025 AT 10:02Really appreciate this breakdown. The distinction between patent expiration and regulatory exclusivity is critical - a lot of folks conflate them. NCE exclusivity, pediatric extensions, orphan drug status - these are all separate legal levers. The Orange Book is the real source of truth, not the patent office. And yes, Paragraph IV certifications are the only real check on evergreening. PTAB challenges are rising because the patents being filed are often frivolous. This isn’t broken - it’s gamed. Systemically.

Nicole K.

December 31, 2025 AT 14:29People complain about drug prices but never say ‘no’ to pills. If you want cheap meds, stop taking them. Simple. If you’re rich enough to buy a Tesla, why are you mad you can’t get Humira for $10? 🤷♀️

Fabian Riewe

January 1, 2026 AT 19:05Love how this explains the real timeline. I work in a clinic and see patients switch from Eliquis to generics - the price drop is insane. One guy was paying $500/month, now he’s at $20. No side effects, same results. The system works… eventually. Just wish it worked faster for folks who need it now.

Amy Cannon

January 1, 2026 AT 20:26It is, indeed, a matter of profound societal significance that the temporal duration of pharmaceutical exclusivity, as governed by the interplay of statutory patent law and administrative regulatory frameworks, is so frequently misunderstood by the lay public. One must appreciate that the 20-year term, while ostensibly a legal construct, is in actuality a temporal scaffold upon which the edifice of innovation is erected - yet, due to the protracted nature of clinical development, the commercial viability window is, in practice, dramatically truncated. Furthermore, the introduction of layered exclusivities - such as orphan drug status and pediatric extensions - serves not as a loophole, but as a necessary incentive mechanism to encourage the development of therapies for underserved populations. To dismiss these mechanisms as mere ‘gaming’ is to misunderstand the delicate balance between access and innovation. The patent system, imperfect as it may be, remains the cornerstone of biomedical advancement.

Himanshu Singh

January 3, 2026 AT 18:59So true! I'm from India and we get generics way faster than the US. My uncle takes a drug that costs $1200/month in America - here it's $12. No joke. The patent stuff is crazy, but it's not fair that people in poor countries suffer because of legal tricks. Hope things change soon 😊

Jasmine Yule

January 4, 2026 AT 11:59Someone needs to call out the pharma lobbyists. This isn’t innovation - it’s legal extortion. I’m sick of seeing families choose between rent and insulin. The 14-year cap after approval? That’s still too long. And if the FTC says it’s evergreening, then it’s EVERRRRRgreening. 💪